Contractors insurance Houston TX is crucial for safeguarding businesses in this busy construction hub known for its booming real estate and industrial base. As Houston stands as a pillar of growth on the Gulf Coast, contractors face unique risks that necessitate comprehensive insurance solutions. Below is a quick checklist of the core needs for contractors seeking to understand their insurance requirements:

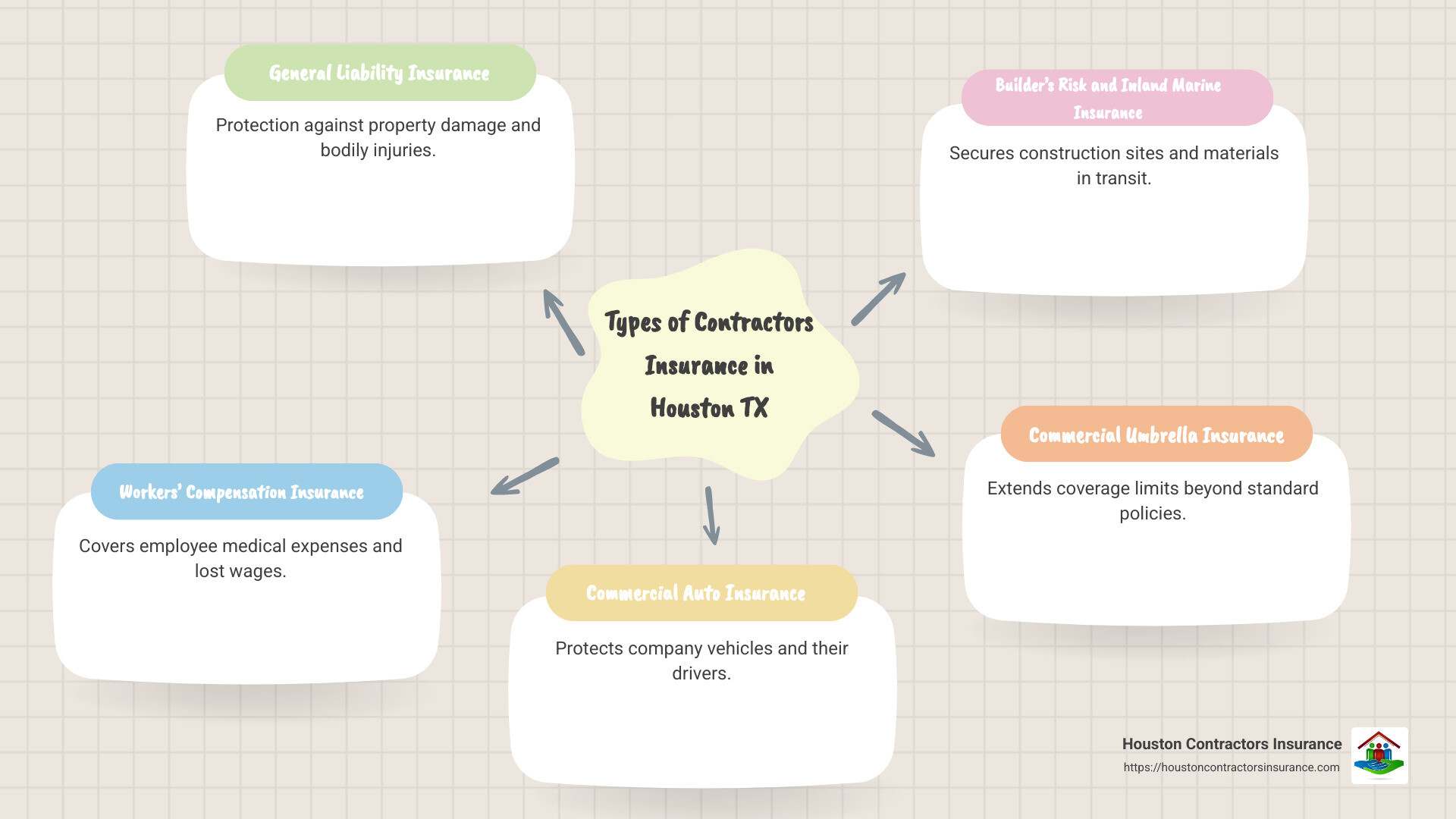

- General Liability Insurance: Essential protection against property damage and bodily injuries.

- Workers’ Compensation Insurance: Covers employee medical expenses and lost wages.

- Commercial Auto Insurance: Protects company vehicles and their drivers.

- Builder’s Risk and Inland Marine Insurance: Secure protection for construction sites and materials in transit.

- Commercial Umbrella Insurance: Extends coverage limits beyond standard policies.

Operating without proper insurance can expose your business to financial risks and fines. Houston's dynamic economy demands robust and custom insurance coverage for professions such as carpenters, electricians, roofers, and general contractors. These professionals must stay insured to win bids and protect their operations.

My name is Sameer Khan, a licensed property and casualty insurance agent with extensive knowledge in Contractors insurance Houston TX. With a background in automotive technology and risk management, I’m passionate about simplifying insurance complexities.

Essential Types of Contractors Insurance

When you're working in the construction industry in Houston, having the right insurance isn't just a good idea—it's a necessity. Here’s a breakdown of the essential types of Contractors insurance Houston TX that you’ll need to keep your business protected:

General Liability Insurance

This is your first line of defense. General Liability Insurance covers you for property damage and bodily injuries that might occur on the job site. Imagine you're renovating a home, and a piece of equipment accidentally damages the client’s property. This insurance helps cover those costs.

- Coverage Includes: Property damage, bodily injury, and even slander or false advertising claims.

- Policy Limits: Typically range from $1M to $2M, depending on your needs and the size of your projects.

Workers’ Compensation Insurance

Your employees are your most valuable asset. Workers' Compensation Insurance ensures they are covered if they get injured on the job. It handles medical expenses and lost wages, providing peace of mind for both you and your team.

- Coverage Includes: Medical bills, lost wages, and rehabilitation costs.

- Importance: Protects you from lawsuits related to workplace injuries.

Commercial Auto Insurance

If your business owns or uses vehicles, Commercial Auto Insurance is a must. This covers any accident-related damages involving your vehicles, whether it’s a collision or damage from weather events.

- Coverage Includes: Collision damage, liability damage, and protection against uninsured motorists.

- Types of Damage: Comprehensive (theft, weather) and collision (accidents).

Builder’s Risk and Inland Marine Insurance

Construction sites are vulnerable to various risks. Builder’s Risk Insurance protects projects under construction from events like fire, theft, and vandalism. Inland Marine Insurance, despite its name, covers materials and equipment in transit over land.

- Builder’s Risk: Covers property damage during construction.

- Inland Marine: Protects tools and materials while being transported.

Commercial Umbrella Insurance

Sometimes, your standard policy limits might not be enough. Commercial Umbrella Insurance provides an extra layer of protection by extending your coverage limits. This is particularly useful if a claim exceeds the limits of your existing policies.

- Coverage Includes: Excess costs not covered by General Liability or Auto Insurance.

- Benefit: Shields you from large, unexpected financial hits.

In the world of Houston construction, having these insurance types ensures you’re prepared for whatever comes your way. Each type of insurance serves a specific purpose, providing a comprehensive safety net for your business operations. Stay covered, stay confident.

General Liability Insurance for Contractors in Houston TX

For contractors in Houston, General Liability Insurance is the foundation of your insurance portfolio. It's crucial to understand its components to ensure you're adequately protected.

Minimum Coverage

In Houston, the minimum General Liability Insurance coverage typically starts at $1,000,000 per occurrence. This means that for any single incident, your insurance will cover up to $1 million in claims. The aggregate limit, which is the total coverage for all claims during the policy period, is usually $2,000,000. These limits are designed to protect you from significant financial losses due to claims.

Policy Limits

The policy limits for General Liability Insurance are essential because they determine the extent of coverage you receive. In Texas, most contractors opt for a $1M/$2M policy, which provides a balance between affordability and comprehensive protection. This level of coverage ensures that you can handle multiple claims within a year without exhausting your insurance resources.

Coverage Types

General Liability Insurance covers a range of incidents that can occur on a job site:

- Property Damage: If you accidentally damage a client’s property during a project, this insurance covers the repair or replacement costs.

- Bodily Injury: This includes coverage for medical expenses if someone is injured on your job site.

- Slander and False Advertising: Protects you against claims of defamation or misleading advertising.

This broad coverage is why General Liability is often the first insurance policy contractors secure.

Importance for Contractors

For contractors, having General Liability Insurance is not just about meeting legal requirements—it's about building trust with clients. Houston clients are discerning and often require proof of insurance before hiring a contractor. A Certificate of Insurance (COI) serves as this proof, detailing your policy limits and coverage types.

Moreover, accidents on construction sites are not uncommon. Whether it's a slip and fall or damage to a client's property, these incidents can lead to costly lawsuits. General Liability Insurance acts as a financial safety net, allowing you to focus on delivering quality work without the constant worry of potential claims.

In the competitive Houston market, being well-insured can be the difference between winning a bid and losing it. Clients are more likely to hire a contractor who can demonstrate they have taken steps to mitigate risks. By investing in comprehensive Contractors insurance Houston TX, you're not just protecting your business; you're also enhancing your reputation and reliability in the industry.

Workers’ Compensation Insurance

When it comes to protecting your employees, Workers’ Compensation Insurance is a must-have for contractors in Houston. This type of insurance is designed to cover the costs associated with employee injuries that occur on the job. Given the physically demanding nature of construction work, accidents can happen, and having this coverage is essential for both the employer and employee.

Employee Protection

Workers’ Compensation Insurance ensures that your employees are taken care of if they get injured while working. This coverage provides peace of mind, knowing that your team is protected against the financial strain that can accompany workplace injuries. It’s not just about compliance; it’s about valuing your workforce.

Financial Impact

The financial impact of a workplace injury can be significant. Without insurance, a single accident could lead to substantial medical bills and lost wages, both of which can be financially devastating for an employee. For employers, it means potentially facing lawsuits or hefty out-of-pocket expenses. Workers’ Compensation Insurance mitigates these risks by covering medical expenses and compensating for lost wages.

Medical Expenses

Injuries on a construction site can range from minor cuts to severe incidents requiring hospitalization. Workers’ Compensation Insurance covers various medical expenses, including hospital stays, surgeries, and medications. This ensures that your employees receive the necessary medical care without the burden of financial stress.

Lost Wages

When an employee is injured and unable to work, their income can take a hit. Workers’ Compensation Insurance helps by providing compensation for lost wages during their recovery period. This financial support is crucial for employees who rely on their paycheck to support themselves and their families.

By investing in Workers’ Compensation Insurance, you are not only fulfilling a legal obligation but also demonstrating a commitment to your employees' well-being. This commitment can lead to a more motivated workforce and a positive reputation in the competitive Houston market.

Commercial Auto Insurance

In the busy world of construction, vehicles are more than just transportation; they're essential tools for getting the job done. That's why Commercial Auto Insurance is crucial for contractors in Houston, TX.

Vehicle Coverage

Whether you're driving a truck loaded with tools or a van transporting materials, your business vehicles need protection. Commercial Auto Insurance covers a range of vehicles used for business purposes. This includes vehicles you own, lease, or rent.

Collision and Comprehensive Coverage

Accidents happen, and when they do, collision coverage steps in. It pays for damages to your vehicle resulting from an accident, regardless of who is at fault. Comprehensive coverage, on the other hand, protects against non-collision-related incidents. This includes theft, vandalism, and natural disasters like hail or floods. Having both ensures that your vehicles are covered no matter what happens.

Liability Damage

Liability coverage is about protecting others. If your vehicle causes damage to another person's property or injures someone, liability insurance covers the costs. This includes medical expenses and repairs, which can quickly add up.

In Houston, the road can be unpredictable. Having Commercial Auto Insurance means you're prepared for the unexpected, keeping your business moving without costly interruptions.

By securing Commercial Auto Insurance, you're safeguarding your assets and ensuring that your business can continue to operate smoothly, even when accidents occur. This protection is not just a smart business move; it's a necessity in the world of construction in Houston.

Builder’s Risk and Inland Marine Insurance

In construction, safeguarding your projects and materials is vital. That's where Builder’s Risk Insurance and Inland Marine Insurance come into play for contractors in Houston, TX.

Construction Site Coverage

Builder’s Risk Insurance is your shield against the unexpected on a construction site. Think of it as a safety net for buildings under construction. Whether it’s a sudden fire, a lightning strike, or even vandalism, this insurance covers the costs of repairing or rebuilding the damaged structure.

Example: Imagine you're a contractor working on a new office building in Houston. A severe storm hits, causing significant damage to the partially completed structure. With Builder’s Risk Insurance, the costs of repairs are covered, saving you from a financial setback.

Property Damage

Property damage during construction can be costly. Builder’s Risk Insurance covers not only the building itself but also materials and equipment on site. If theft or an "Act of God" like a hurricane occurs, your investment is protected.

Case Study: A contractor in Houston faced theft of expensive materials from a construction site. Thanks to Builder’s Risk Insurance, the financial impact was minimized, allowing the project to continue without major delays.

Transportation Protection

Inland Marine Insurance is not about boats! It's about covering your materials and equipment as they travel over land. From the moment they leave the supplier until they arrive at the site, this insurance ensures they are protected against accidents and theft.

Scenario: You’re transporting high-value construction materials across Houston. An accident occurs, damaging the goods. With Inland Marine Insurance, the loss is covered, preventing a hit to your budget.

By investing in Builder’s Risk and Inland Marine Insurance, contractors in Houston can focus on building with confidence, knowing their projects and materials are protected from the unexpected. This coverage is essential for maintaining the momentum of your construction projects, no matter what challenges arise.

Frequently Asked Questions about Contractors Insurance in Houston

How much does a $1,000,000 liability insurance policy cost?

For small business owners in Houston, securing a $1,000,000 liability insurance policy is a crucial step toward protecting your business. On average, this type of policy can cost around $23 per month. However, the exact amount may vary based on factors like the size of your business, the type of contracting work you do, and your claims history.

Tip: To get the best rate, consider bundling insurance policies or increasing your deductible. These strategies can help lower your monthly premium while maintaining the necessary coverage.

Do contractors in Texas need insurance?

In Texas, while not all contractors are legally required to have insurance, having it is highly recommended. General Liability Insurance is essential for most contractor professions, covering property damage and bodily injury claims. For peace of mind, many contractors also opt for Workers’ Compensation Insurance, which supports employees who get injured on the job.

Key Professions: Contractors in fields such as HVAC, electrical, plumbing, and general construction often carry these insurances to protect their businesses and employees. This coverage ensures compliance with client requirements and helps avoid potential legal issues.

What is the best insurance for a contractor?

The best insurance for a contractor in Houston is one that offers affordable plans and flexible coverage custom to your specific needs. A comprehensive plan usually includes General Liability, Workers’ Compensation, and Commercial Auto Insurance. These coverages protect your business from various risks, whether on-site or during transportation.

Flexible Coverage Options: Look for insurance providers that offer customizable plans. This allows you to adjust your coverage as your business grows or changes, ensuring you always have the right protection in place.

By understanding the costs, legal requirements, and best options for contractors insurance in Houston, you can make informed decisions that safeguard your business and allow you to focus on what you do best—building and growing your enterprise.

Conclusion

At Houston Contractors Insurance, we understand the unique challenges contractors face in the busy Houston construction scene. Our mission is to provide you with the peace of mind that comes from knowing your business is well-protected.

Personalized Service: We pride ourselves on offering personalized service custom to the specific needs of contractors in Houston and Harris County. Whether you're a general contractor or a specialized tradesperson, our team is here to guide you through the insurance process, ensuring you get the coverage that fits your business perfectly.

Quick Online Quotes: Time is of the essence in the construction industry. That's why we offer quick online quotes to get you insured faster. Our streamlined process allows you to receive a quote without the hassle, so you can focus on what truly matters—completing your projects on time and within budget.

By choosing Houston Contractors Insurance, you're not just buying a policy; you're investing in a partnership dedicated to your success. Let us help protect your business with contractors insurance Houston TX solutions that are both comprehensive and competitively priced.

To explore our offerings, including General Liability Insurance in Houston, visit our website today. Let's build a safer future together.