How much are surety bonds in Texas? If you're searching for a quick answer, here's the gist: Surety bonds in Texas typically cost between 1% and 10% of the bond amount. For a $10,000 bond, costs can range from $100 to $1,000, largely influenced by factors like your credit score, bond type, and financial background.

In the vast landscapes of Texas, operating a construction business comes with its set of challenges and assurances. Surety bonds serve as a financial guarantee, ensuring that business obligations are fulfilled properly—essential for obtaining business licenses or permits in the Lone Star State. Whether you're starting a new project or maintaining compliance with state regulations, understanding the role of surety bonds can help you manage risk, foster trust, and ensure accountability.

I'm Sameer Khan, and my experience spans from automotive technology to property and casualty insurance, giving me a firm grasp on how much are surety bonds in Texas. Let's explore the details of Texas surety bonds, setting the foundation for making informed decisions in your construction business.

Understanding Surety Bonds

Surety bonds might sound complicated, but they're pretty straightforward once you break them down. Think of a surety bond as a promise. It's a promise that a job will get done or an obligation will be met. In Texas, surety bonds are crucial for businesses, especially in construction, where they act as a safety net for everyone involved.

What is a Surety Bond?

A surety bond is a legally binding agreement involving three parties:

- Principal: The person or business required to get the bond.

- Obligee: The entity that requires the bond. This could be a government agency or a private business.

- Surety: The company that issues the bond, guaranteeing that the principal will fulfill their obligations.

If the principal fails to meet their obligations, the obligee can file a claim against the bond. The surety investigates the claim and, if valid, pays the obligee. The principal must then reimburse the surety.

Purpose of Surety Bonds

The primary purpose of surety bonds is to protect the obligee from financial loss. They ensure that the principal performs their duties ethically and lawfully. For example, in construction, surety bonds assure project owners that contractors will complete projects as agreed.

Types of Surety Bonds

Texas requires various types of surety bonds, each serving a unique purpose:

- Contract Bonds: These include bid bonds, performance bonds, and payment bonds, primarily used in construction projects.

- Commercial Bonds: Required for businesses to operate legally, such as license and permit bonds.

- Court Bonds: Needed in legal proceedings, like appeal bonds or guardianship bonds.

Each bond type has specific requirements and serves to protect different parties in various situations.

Surety bonds are a fundamental part of doing business in Texas. They help manage risk, build trust, and ensure accountability. Understanding these bonds can give you peace of mind and the ability to operate smoothly in the Lone Star State.

How Much Are Surety Bonds in Texas?

When you're looking to get a surety bond in Texas, one of the first questions you'll likely ask is, "How much are surety bonds in Texas?" The cost of a surety bond varies widely, but understanding the factors that influence this cost can help you plan better.

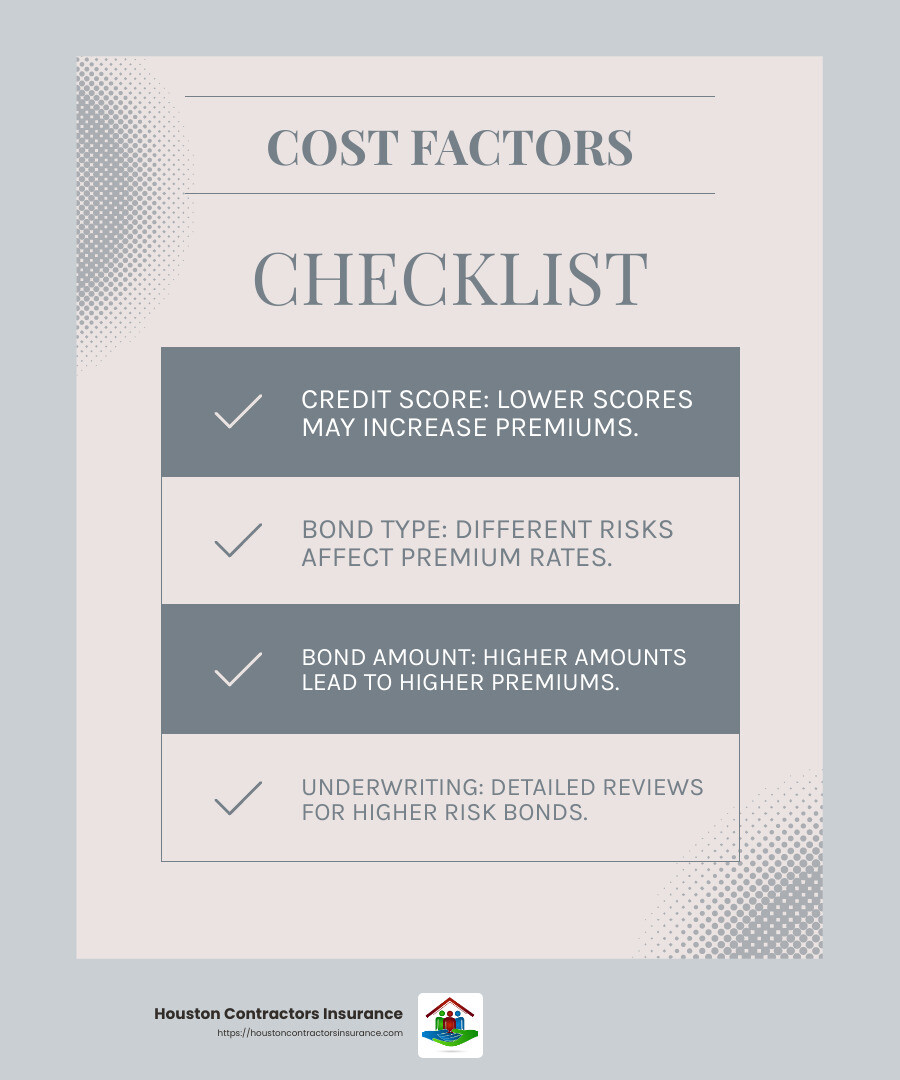

Factors Influencing Surety Bond Costs

The cost of a surety bond is typically a small percentage of the total bond amount. This percentage is known as the bond premium, and it usually ranges from 0.5% to 10% of the bond amount. Several key factors influence this rate:

- Credit Score: Your credit score plays a significant role in determining the premium. Applicants with excellent credit (675+) often see lower rates, typically between 0.5% and 4%. If your credit score is lower, the rate might be higher due to increased perceived risk.

- Bond Type: Different bonds carry different risks. For example, auto dealer bonds may have higher premiums compared to low-risk bonds like business service bonds.

- Bond Amount: Higher bond amounts usually mean higher premiums. For instance, a $100,000 bond will generally cost more than a $5,000 bond.

- Underwriting: For some bonds, especially those that involve higher risk or larger amounts, an underwriting process is required. This involves a detailed review of financial statements, work history, and other factors that assess the risk of issuing the bond.

Example Costs for Common Bonds

To give you a clearer picture, let's look at some example costs for common bond amounts:

- $5,000 Bond: For someone with excellent credit, the premium might range from $25 to $250. With average or poor credit, it could be higher.

- $10,000 Bond: The cost could range from $50 to $1,000, depending on credit and other factors.

- Business Service Bonds: These are generally low-risk and can be more affordable. They might range from $100 to $500 for a standard amount.

These examples illustrate that while the cost of surety bonds in Texas can vary, understanding the influencing factors can help you estimate your expenses more accurately. By improving your credit score and providing solid financial documentation, you can potentially lower your bond costs.

In the next section, we'll explore how to obtain a surety bond in Texas, including the application process and how to get quotes online.

How to Obtain a Surety Bond in Texas

Acquiring a surety bond in Texas is a straightforward process, but it involves a few key steps. Understanding these steps can make the process smoother and quicker for you.

Steps to Purchase a Surety Bond

- Contact the Obligee

Start by identifying the obligee—the entity requiring the bond. They will provide details on the type of bond you need and the required bond amount.

- Submit an Application

Once you know what bond you need, the next step is to fill out a bond application. This can often be done online, making it convenient and fast. You'll need to provide personal and business information, such as your credit score and financial history.

- Receive a Quote

After submitting your application, you'll receive a quote for your bond premium. This quote is based on factors like your credit score, the bond amount, and the type of bond. Many surety companies offer instant online quotes, so you can get a quick estimate.

- Pay the Premium

Once you agree to the quote, you'll need to pay the bond premium. This payment is necessary for the issuance of the bond. Some companies offer premium financing options to spread out the cost if needed.

- Receive Your Bond

After payment, you'll receive your bond, often through digital delivery. This means you can have your bond in hand almost immediately, ready to file with the obligee.

- File Your Bond

The final step is to file the bond with the obligee. This completes the bonding process, ensuring you meet the legal or contractual requirements.

By following these steps, you can efficiently secure a surety bond in Texas. The process is designed to be quick and straightforward, especially with the availability of online applications and instant quotes.

In the next section, we'll address some frequently asked questions about surety bonds in Texas, including costs and considerations for those with bad credit.

Frequently Asked Questions about Surety Bonds in Texas

How much does a surety bond cost in Texas?

The cost of a surety bond in Texas varies but typically ranges from 1% to 10% of the bond amount. This percentage is known as the bond premium. For example, if you need a $5,000 bond, you might pay between $50 and $500, depending on factors like your credit score and the type of bond.

Can I get a surety bond with bad credit?

Yes, you can still get a surety bond even if you have bad credit. Many surety companies offer bad credit programs that approve 99% of applicants. However, be prepared to pay a higher bond premium if your credit score is low. This is because your credit score helps underwriters assess the risk of issuing the bond. The higher rate compensates for the increased risk.

Are surety bond premiums refundable?

Once a surety bond is issued, the premium is nonrefundable. This is because the premium is considered earned by the surety company at the time of issuance, regardless of whether a claim is made against the bond. Even if you cancel the bond or your business closes before the bond term ends, you won't receive a refund for the premium paid.

Conclusion

Navigating surety bonds in Texas might seem daunting, but it doesn't have to be. At Houston Contractors Insurance, we are dedicated to simplifying this process for contractors in Houston and Harris County. Our mission is to provide personalized service that caters to your unique needs, ensuring you get the right coverage without unnecessary hassle.

One of our standout features is the ability to offer quick online quotes. This means you can get an estimate for your surety bond in just a few minutes, saving you time and effort. Our team of experts is ready to assist you every step of the way, from choosing the right bond to understanding the costs involved.

We understand that every contractor's situation is different, which is why we offer custom solutions that fit your specific requirements. Whether you have perfect credit or are working through credit challenges, we strive to find the most competitive rates for your surety bond needs.

If you're ready to experience the ease and efficiency of working with Houston Contractors Insurance, visit our affordable surety bonds page to get started. Let us help you secure your business and build a solid foundation for success.