If you want to buy surety bonds quickly and easily, follow these simple steps:

- Determine the Bond Type and Amount: Contact the obligee (the party requiring the bond) to get specific bond details.

- Find a Quality Provider: Choose a licensed surety bond provider known for fast online service and good customer reviews.

- Complete the Application: Submit the required documents and information online.

- Pay and Receive the Bond: After payment, receive your bond certificate electronically or by mail, often instantly.

Surety bonds give construction firms like yours a financial guarantee. They show your clients that you'll complete projects as promised. Whether you're bidding on jobs or meeting licensing requirements, buying the right surety bond helps your business grow securely.

I'm Sameer Khan, a licensed property and casualty insurance agent and owner at TWFG Insurance in Houston, Texas. My experience in helping construction business owners buy surety bonds has equipped me to simplify this process for your company.

What Is a Surety Bond and How Does It Work?

A surety bond is a financial guarantee and a legally binding contract between three parties. It ensures that specific obligations are met according to agreed terms. Think of it as a promise backed by money, giving your clients confidence that you're committed to delivering on your commitments.

But wait—let's clear something up first: a surety bond is not the same thing as insurance. Insurance protects you, the policyholder, from losses. A surety bond, on the other hand, is designed to protect someone else (the "obligee") if you (the "principal") fail to fulfill your promises.

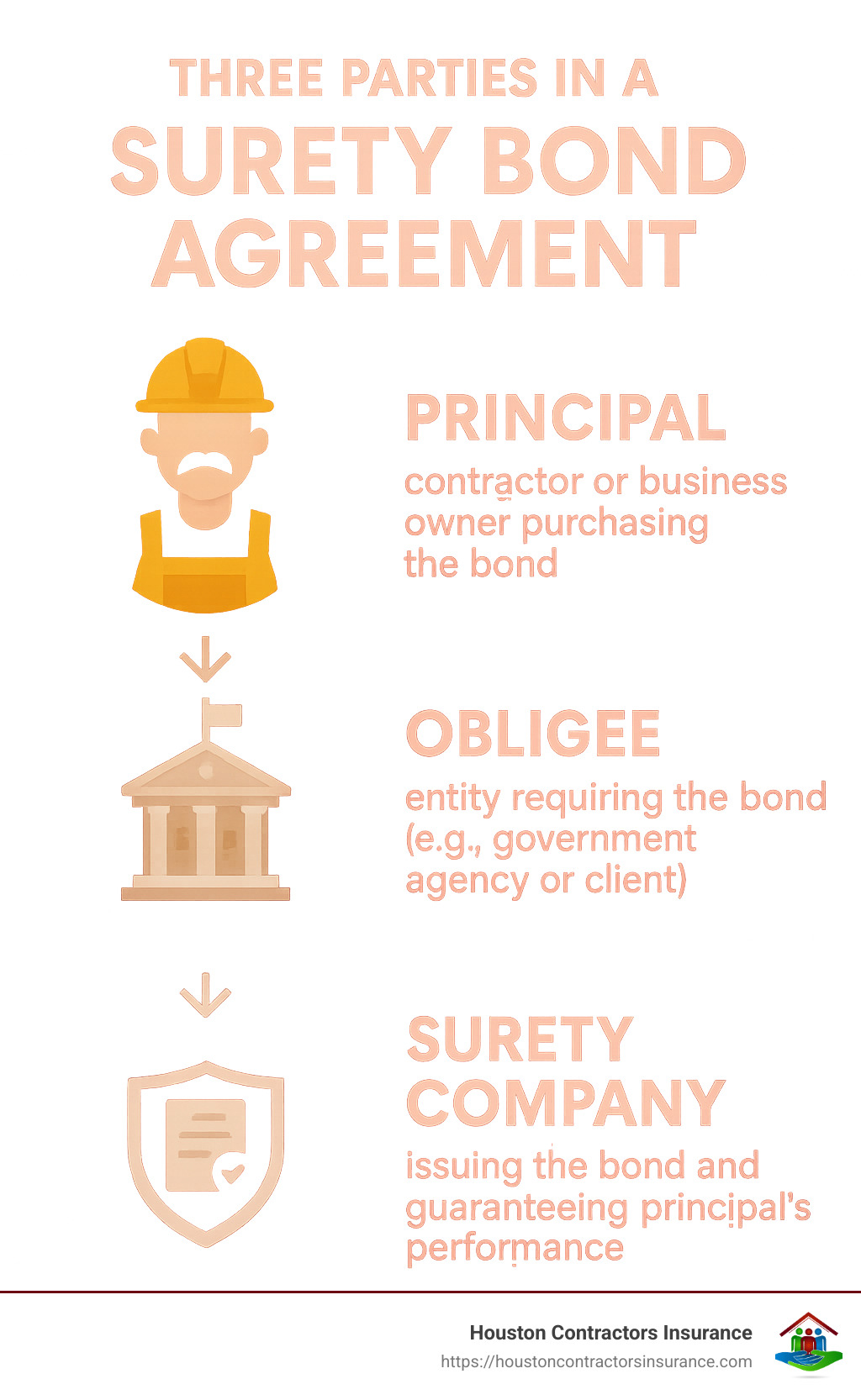

"A surety bond is a legally binding contract between three parties: the principal, the obligee, and the surety."

Now, let's break this down so it makes sense:

First, we have the principal. This one's easy—that's you! You're the contractor, business owner, or individual required to purchase the bond. By doing so, you're committing to perform a job or obligation exactly as promised.

Next up is the obligee. This is usually a government agency, a project owner, or the client you're working for. They require the bond to get reassurance that you'll complete your work according to the contract or laws in your industry.

Finally, there's the surety. This is typically an insurance company that issues your bond. They're essentially stepping up to say, "Hey, we'll vouch for the principal. If something goes wrong, we've got it covered." Of course, there's a catch—if the surety pays a claim on your behalf, they'll expect reimbursement from you afterward.

When you buy surety bonds, you're not paying for your own protection. Instead, you're investing in your professional credibility by providing your clients and partners with peace of mind. It's a way to demonstrate your commitment to following through, meeting deadlines, and complying with regulations.

As Shannon G., a satisfied customer, explains: "My experience was amazing. I love that I can simply go online and get what I need. The process is simple and efficient."

Here's a quick visual summary of the three parties involved:

In short, a surety bond is more than just paperwork—it's your promise to clients and regulators that you'll deliver exactly what you've agreed upon. It's good for your reputation and great for your business.

Types of Surety Bonds You Can Buy

When I talk with contractors and business owners about their bonding needs, many are surprised to learn there are over 3,000 different surety bonds available across all 50 states. It's like walking into a hardware store looking for "a screw" – you need to know which specific type fits your project!

Let's break down the main categories of bonds you might need for your business, so you can feel confident when you buy surety bonds for your specific situation.

License and Permit Bonds

Think of these as your "permission to operate" bonds. Government agencies require these before you can get your professional license or permit. They're essentially your promise to follow all the rules and regulations in your industry.

If you're a contractor, auto dealer, mortgage broker, or notary public, you'll likely need one of these bonds. They protect the public by ensuring you'll conduct business ethically and according to the law.

Contract Bonds

For my construction clients, these are usually the most common bonds they need. Contract bonds guarantee the performance of construction contracts and are particularly important for public works projects.

Within this category, you'll find bid bonds that guarantee you'll accept the job and provide required performance bonds if awarded the contract. Performance bonds ensure you'll complete the project according to specifications, while payment bonds guarantee you'll pay your subcontractors and suppliers. There are also maintenance bonds that cover any defects in workmanship or materials for a specified period after you complete the project.

Court Bonds

These bonds come into play during legal proceedings. If you're involved in probate matters, filing an appeal, seeking an injunction, or need an attachment bond, the court may require you to buy surety bonds to protect other parties involved in the case.

Fidelity Bonds

Business owners often purchase these to protect themselves from employee dishonesty or theft. Popular types include ERISA bonds for employee benefit plans, business services bonds, and employee dishonesty bonds. They provide peace of mind that your business assets are protected from internal threats.

Commercial Bonds

This catch-all category includes various bonds for specific business operations. You might need tax bonds, utility bonds, warehouse bonds, or lost instrument bonds depending on your industry and operations.

I recently helped David B., a contractor in Texas, steer his bonding requirements. As he shared: "The whole team was awesome to work with. They understood my needs, were highly responsive, and even helped me solve an error I made."

Finding the right bond doesn't have to be complicated. Understanding which category your needed bond falls into is the first step toward ensuring your business operates smoothly and legally. If you're unsure which specific bond you need, our team can help guide you through the options based on your industry, location, and project requirements.

Why You Need to Buy Surety Bonds

Understanding why you need to buy surety bonds is just as important as knowing how to get one. Surety bonds aren't just paperwork—they're powerful tools that open doors, build trust, and help your business thrive.

Legal Requirements and Licensing

Most states, including Texas, have strict rules requiring businesses to obtain surety bonds as part of their licensing process. Whether you're an auto dealer, contractor, or notary, a surety bond is often mandatory before you can even open your doors.

As the Small Business Administration (SBA) explains, "Surety bonds are essential in industries where contracts require guarantees that work will be completed or payment will be made." In other words, no bond—no business license. It's as simple (and as important!) as that.

Building Trust and Credibility

When clients see you’ve chosen to buy surety bonds, it sends a powerful message. It tells them you're responsible, dependable, and financially stable enough to stand behind your promises. This reassurance can give you a significant advantage over competitors who aren't bonded.

Tommy W., a long-time bond holder, puts it perfectly: "The people have great knowledge of all types of bonds and how to get you the best deal fast!" In other words, having a surety bond impresses clients—and keeps your phone ringing.

Protection for All Parties

Surety bonds offer peace of mind to everyone involved in your projects. For your clients and obligees, they receive financial protection if you don't fulfill your contract obligations. For your business, bonding helps you avoid costly disputes or misunderstandings by clearly defining expectations. And for the public, bonds help ensure businesses operate ethically and responsibly—protecting everyday consumers from fraudulent or questionable practices.

When you buy surety bonds, you're essentially creating a safety net that keeps everyone involved safe and satisfied. It's a win-win-win scenario.

Access to More Projects

Want to tackle bigger, more profitable jobs? Many government contracts and large private projects won't even let you bid without proper bonding. Simply put, if you don't have the right bonds, you might miss out on valuable opportunities.

Jake E., a contractor, confirms how easy getting bonded can be with the right provider: "So glad we found this company, they make the process so simple! Really impressed with how quickly they helped us get our bid bonds."

Bottom line: when you take the step to buy surety bonds, you open the doors to bigger and better opportunities, allowing your business to truly thrive.

How to Buy Surety Bonds Online

The days of endless paperwork and long waits are thankfully behind us. Now, thanks to modern technology, you can easily buy surety bonds online in just a few simple steps. What used to take days or even weeks can now be accomplished in minutes from your home or office.

Before we dive into the steps, here's a quick tip to ease your mind: you won't need to pay the full bond amount. Most clients only pay between 1% and 5% of the total bond amount. For example, if your required bond is $25,000 and you're quoted at a 1% rate, your cost is just $250—pretty good deal, right?

Step 1: Determine the Type of Surety Bond You Need

The first step to buy surety bonds online is figuring out exactly what bond you need. Reach out to the obligee—the agency or project owner requiring the bond—and ask them to specify the bond name, type, and amount. Confirm any special wording or requirements for the bond, as well as deadlines for submission.

Doing this homework upfront ensures you're getting exactly what you need and helps avoid delays. (Plus, it makes you look organized—always a nice bonus!)

As Spencer B., a satisfied business owner, shares: "Outstanding speed and service. Would definitely recommend."

Step 2: Find a Reputable Surety Bond Provider

Next up, you want to choose a surety bond provider you can trust. There's no shortage of providers out there, but not all of them are created equal. To find the right one, make sure they meet these key criteria: they're licensed in your state, have plenty of positive customer reviews, offer competitive rates, and are experienced in handling your specific bond type. Speedy service doesn't hurt either—many good providers now offer same-day or even instant bond issuance!

Of course, we're a little biased, but at Houston Contractors Insurance, we take pride in offering personalized service, fast online processing, and highly competitive rates. As one of our customers, Edwin Soyfer, puts it: "Cannot believe how easy the process was. This company is the gold standard in customer service and efficiency."

Step 3: Complete the Application Process

Filling out the online application to buy surety bonds is straightforward and quick—you'll be guided step-by-step. You'll typically need some basic personal and business information such as your name, address, business type, and contact details. Depending on the bond size, you might also need to provide financial statements or tax returns.

Most providers will run a soft credit check (this doesn't affect your credit score, so don't worry!). The application systems today are designed to be simple, secure, and fast—often letting you purchase the bond the same day you apply. If you want to learn more about getting bond-ready, you can check out the helpful resources from the Bonding Education Program.

Step 4: Pay the Premium and Receive Your Bond

Once you're approved, you'll receive a quote clearly showing your premium—the percentage you pay for the bond amount. Carefully review this information, and when you're ready, make your payment securely online. Providers commonly accept credit cards, electronic checks, or ACH transfers.

After payment, you'll typically receive your surety bond immediately by email. Some providers also offer the option to mail a physical copy if needed. From there, simply submit the bond to the obligee as required, and you're all set!

As Zachary Creel, another satisfied client, shares: "A+ company to do business with. No hassle and they didn't try to overcharge like another big-name bond company that's all over the internet."

That's it—four easy steps, and you're done! When you buy surety bonds online, you'll enjoy a smoother, faster, and more convenient experience, letting you quickly get back to doing what you do best—running your business.

Factors That Affect Surety Bond Cost

When you're ready to buy surety bonds, it's helpful to understand exactly what goes into the pricing. After all, getting a great rate means more money stays in your pocket—always a good thing, right?

The cost of a surety bond is usually a small percentage of the bond amount itself, often ranging from just 1% to about 5%. For example, if your bond requirement is $50,000 and your rate is quoted at 2%, you'll pay $1,000.

But what exactly determines whether you pay 1% or 5%—or maybe even more? Let's unpack the key factors impacting the price of your bond.

Bond Amount

The first factor is pretty straightforward—the bond amount itself. A higher bond amount represents a bigger financial risk to the surety company, so naturally, your premium goes up. The good news? Often, as the bond amount gets bigger, the percentage rate you pay actually goes down. It's like buying in bulk—the more you buy, the better the price!

Bond Type

Another factor is the type of surety bond you're buying. Different bonds have different levels of risk. For example, license and permit bonds typically present lower risk than construction-related contract bonds. Lower-risk bonds usually come with lower rates.

Credit Score

Your personal credit score is one of the biggest factors surety companies look at. Surety providers use credit scores to measure how likely applicants are to meet their obligations. If you have excellent credit (700+), you're likely to snag the lowest rates—usually around 1-3%. Good or fair credit (600-699) might land you somewhere between 2-5%.

But don't panic if your credit is less than perfect! There's still hope (more on that in a minute).

Business Financials

For larger bond amounts, the surety company will also take a closer look at your business finances. They'll likely review your balance sheet, income statement, working capital, and net worth. Simply put, they want to make sure your business is stable and able to fulfill its obligations. Good financials mean lower premiums—so keeping your financial records neat and polished pays off.

Industry Experience

Your industry track record counts, too. Providers love experienced contractors who've completed plenty of successful projects. If you have years of solid experience, expect your rate to reflect that positively. If you're newer, you may have to pay a bit more initially—but don't worry, your rates will improve with each successful project!

Claims History

Finally, your personal claims history matters. If you've had previous claims against your bonds, this could bump your premium up quite a bit. Providers see this as an increased risk—so keeping a clean record is definitely beneficial.

A fellow business owner, Angela Arnold, summed up her experience nicely: "I was extremely pleased with not only the rate I received but the excellent communication."

To explore more about specific bonds like vehicle title bonds, check out this helpful guide on Surety Bond for Vehicle Title Texas.

How Does Credit Score Impact Approval and Rates?

When you buy surety bonds, your credit score is a big deal—but how much does it really affect your approval and rates?

If your credit is excellent (700+), congratulations! Approval is usually fast and easy, and your rates will typically be from around 1% to 3%. You might even qualify for instant issue bonds online.

Good credit (650-699) is still comfortably within the approval range. Your rates will likely sit between 2% and 4%, and the process remains straightforward, though you might need to provide a few extra details.

With fair credit (600-649), you can still get your bond, but expect a bit more scrutiny. Rates typically start around 3% and run up to around 5%. You may be asked to provide additional information and financial statements.

Finally, if your credit score is below 600, you can still get your surety bond—but expect a more detailed underwriting process, higher premiums (5% to 15%), and possibly collateral or additional guarantees.

But remember, credit isn't everything. A strong business history, healthy financials, and industry experience can help balance out credit challenges and keep your rates reasonable.

Can You Buy Surety Bonds with Bad Credit?

The short (and comforting) answer? Yes, you absolutely can buy surety bonds even with bad credit. So if your credit score has taken a few hits, don't worry: it's not the end of the world, and it certainly doesn't mean the end of your business dreams.

Here's what you should expect if your credit is less than ideal:

- Higher Premiums: You'll probably pay between 5% and 15% of the bond amount.

- Specialized Programs: Some providers offer custom plans specifically designed for applicants with challenged credit.

- Collateral: You may be asked to put up collateral like cash, a letter of credit, or property as additional security.

- Co-signers: Having a financially strong co-signer can significantly help your application.

- More Financial Documentation: Be prepared to submit detailed financial statements or even a business plan to explain your current situation.

At Houston Contractors Insurance, we've seen it all—and we know how to help. Our experienced agents specialize in finding solutions for contractors facing credit challenges. After all, we believe everyone deserves a chance to succeed, regardless of credit history.

Buying a surety bond, even with bad credit, is achievable when you have the right team behind you. And that's exactly what we offer—warm, personalized service that helps simplify the whole process.

Frequently Asked Questions about Buying Surety Bonds

Buying surety bonds can feel overwhelming at first. But don't worry—you're not alone! Below, we've answered some of the most common questions business owners ask when they're ready to buy surety bonds.

What Documents Do I Need When Buying a Surety Bond?

The exact documents you'll need can vary depending on the bond type and how large the bond amount is. At a minimum, every bond application will ask you for a completed bond application, a copy of your government-issued ID, and any required business license or entity documents (like your LLC or corporation paperwork).

For larger bonds (usually over $250,000), the surety company might want to take a closer look at your financial health. In these cases, you'll likely need to provide recent financial statements, such as a balance sheet or income statement, along with bank references and possibly details about your past projects or work history.

Certain bonds require specific documentation to verify your eligibility. For instance, if you're applying for a contract bond, you'll need to include a copy of the contract or bid request. Similarly, a license bond will usually require a copy of your license application, and a court bond may require relevant court documents tied to your situation.

If you're not sure exactly which documents you need, the simplest thing to do is contact the obligee—the party or agency that's requiring you to buy the bond. They'll tell you exactly what's required to ensure a smooth application process.

How Long Does It Take to Get a Surety Bond?

Great news: buying surety bonds doesn't have to be a drawn-out process anymore! In fact, many common license and permit bonds can now be issued instantly online. You can complete your application, pay the premium, and receive your bond certificate within minutes.

For standard bonds under $500,000, the approval process usually only takes 1–2 business days once your complete application is submitted. Larger contract bonds or bonds requiring a more thorough underwriting review might take a little longer—usually around 3–5 business days.

If your credit history isn't perfect, don't worry; you're not out of luck. You can still buy surety bonds, but you may need to provide additional financial details, which can add a little extra time—typically between 3–7 business days. Working with an experienced surety bond provider (like us here at Houston Contractors Insurance!) can speed up this process significantly.

Are Surety Bonds Refundable if No Longer Needed?

Sometimes plans change, and that's okay. But can you get a refund if you no longer need your surety bond? The answer depends on the type of bond and your provider's policies.

Many common commercial and license bonds can be cancelled. Usually, this means you'll receive a pro-rated refund for the unused portion of your premium. To cancel these bonds, you'll typically need to submit a formal cancellation request, return the original physical bond certificate (if applicable), and obtain written confirmation from the obligee releasing the bond.

However, certain bonds—especially contract bonds such as bid bonds, performance bonds, or payment bonds—are normally non-refundable. Once these bonds are issued, providers typically can't offer refunds since the bond was already issued for a specific contract or project.

If your bond application is declined, or if your submitted bond is rejected by the obligee due to incorrect information, most reputable providers (including our team here at Houston Contractors Insurance) will issue a full refund of any amounts you've paid or offer a replacement bond at no extra cost.

In short: always ask your surety bond provider about their refund and cancellation policies before you make a purchase, just so you're clear about what to expect.

Conclusion

Navigating the process to buy surety bonds doesn't have to be complicated. Throughout this guide, we've walked through everything from understanding different bond types to completing applications efficiently. With the right knowledge, you can secure the perfect bond at the best possible rate.

When you're ready to buy surety bonds, keep these essential points in mind:

First, always verify your exact requirements with the obligee. This simple step prevents costly mistakes and ensures you get precisely the bond you need. As we've seen, there are thousands of bond types available, and getting the wrong one can delay your projects or licensing.

Second, while we at Houston Contractors Insurance pride ourselves on competitive rates and exceptional service, it's always smart to compare options. Different providers may offer varying rates based on your specific situation, especially if you have credit challenges.

Preparing your documentation in advance makes everything smoother. Having your business and financial information organized and ready to go can turn what used to be a week-long process into something you can complete in minutes. This preparation is particularly important for larger bonds that require more extensive underwriting.

Your credit score plays a significant role in determining your bond rate, but don't let credit challenges discourage you. Even with less-than-perfect credit, options exist to help you secure the bonds you need. We've helped countless contractors with varied credit histories find solutions that work for their businesses.

Perhaps most importantly, don't delay. The digital revolution in the surety bond industry means many bonds can now be issued instantly online. This speed allows you to meet tight deadlines and seize business opportunities without unnecessary waiting.

As Jake E., one of our satisfied customers, shared: "So glad we found this company, they make the process so simple! Really impressed with how quickly they helped us get our bid bonds."

At Houston Contractors Insurance, we truly understand the unique needs of contractors in Harris County and throughout Texas. Our team specializes in helping construction professionals buy surety bonds quickly and at competitive rates. We're not just another insurance agency – we're partners in your business success.

We offer personalized service from agents who understand the construction industry inside and out. Our team members speak your language and know the challenges you face. We provide quick online quotes and digital bond delivery, often getting you bonded the same day you apply. With access to multiple surety markets, we shop around for you to find the best possible rates for your specific situation. And our expertise in Texas-specific bond requirements means you'll never have to worry about compliance issues.

Whether you need a contractor license bond to legally operate your business, a bid bond to compete for that exciting new project, a performance bond to secure a contract, or any other surety product, we're here to make the process as seamless as possible.

Ready to get started? Contact us today for a free, no-obligation quote on your surety bond needs. Our experienced team is standing by to help your construction business grow securely with the right surety bonds in place. We've simplified the process of buying surety bonds so you can focus on what you do best – building and growing your construction business.